Learn about our environmental, social, and governance program, and how we bring those values to life with green bonds, sustainable projects, and more.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about our environmental, social, and governance program, and how we bring those values to life with green bonds, sustainable projects, and more.

About Our Program

NIFA has issued the following Single Family Housing Revenue Social Bonds:

- Single Family Housing Revenue Bonds 2024 Series G (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2024 Series E (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2024 Series C (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2024 Series A (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2023 Series G (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2023 Series E (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2023 Series C (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2023 Series A (Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2022 Series F (Non-AMT) (Social Bonds) & Series G (AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2022 Series D (Non-AMT) (Social Bonds) & Series E (Variable Rate - Non-AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2022 Series A (Non-AMT) (Social Bonds), Series B (AMT) (Social Bonds), & Series C (Variable Rate - AMT) (Social Bonds)

- Single Family Housing Revenue Bonds 2021 Series C (Non-AMT) (Social Bonds)

NIFA has determined, by reference to the International Capital Market Association’s (“ICMA”) “Green and Social Bonds: High Level Mapping to the Sustainable Development Goals,” that NIFA’s use of the proceeds of NIFA designated Social Bonds is consistent with the following Sustainable Development Goals in ICMA’s Social Bond Principles:

- Goal 1: No Poverty

- Goal 8: Decent Work and Economic Growth

- Goal 10: Reduced Inequalities

- Goal 11: Sustainable Cities and Communities

of the United Nations 17 Sustainable Development Goals (referred to as “UNSDGs” generally and “SDG 1,” “SDG 8,” “SDG 10,” and “SDG 11,” specifically). The UNSDGs were adopted by the United Nations General Assembly in September 2015 as part of the United Nation’s 2030 Agenda for Sustainable Development. See sdgs.un.org/goals. The seventeen (17) UNSDGs were designed as a plea to countries for global efforts to end poverty, improve health and education, reduce inequality and spur economic growth, together with other environmental goals. According to the United Nations, SDG 1 is focused on ending poverty in all its forms everywhere, SDG 8 is focused on sustainable and inclusive growth, SDG 10 is focused on the needs of disadvantaged and marginalized populations, and SDG 11 is focused on making cities and communities inclusive, safe, resilient and sustainable. The ICMA’s “Green and Social Bonds: High Level Mapping to the Sustainable Development Goals” maps SDG 1.4 to ICMA Social Bond Principles “Affordable Housing,” “Socioeconomic Advancement and Empowerment,” and “Access to Essential Services;” maps SDG 8.10 to ICMA Social Bond Principle “Access to Essential Services;” maps SDG 10.2 to ICMA Social Bond Principles “Socioeconomic Advancement and Empowerment” and “Access to Essential Services;” and maps SDG 11.1 to ICMA Social Bond Principles “Affordable Housing” and “Affordable Basic Infrastructure.”

NIFA’s Mission and Summary Statistics of Bond Financed Mortgage Loans (2022-2024)

NIFA’s mission is to grow Nebraska communities, a linchpin of which is availability of affordable housing. NIFA supports affordable housing, in part, by providing financing for owner occupied homes and multifamily rental housing.

NIFA provides Nebraskans with a broad range of financial resources for homeownership for low- and moderate-income persons and families (in connection with the First Home Program, primarily for first-time homebuyers), rental housing for low- and moderate- income persons and families, agriculture for “first-time” farmers and ranchers, manufacturing, and medical and community development endeavors. NIFA also provides technical assistance for activities related to these areas, particularly in the area of affordable housing.

NIFA finances single-family housing for occupancy by low- and moderate-income persons and families in the State primarily through the issuance of bonds, carrying out its longstanding Program and the Other Single Family Programs, which advances NIFA’s mission of growing Nebraska communities by supporting their respective housing needs. As of December 31, 2024, NIFA, including its predecessor, had financed over 101,000 loans through the First Home Program and the Other Single Family Programs. NIFA also provides down payment and closing costs assistance to its Mortgagors and offers homebuyer education through various resources, including the Master Servicer, Fannie Mae and Freddie Mac.

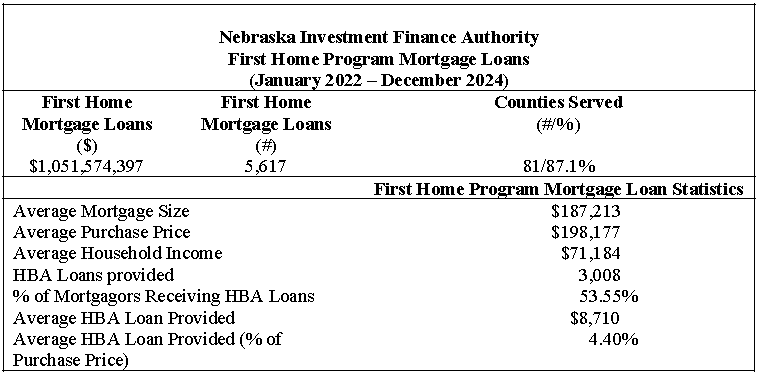

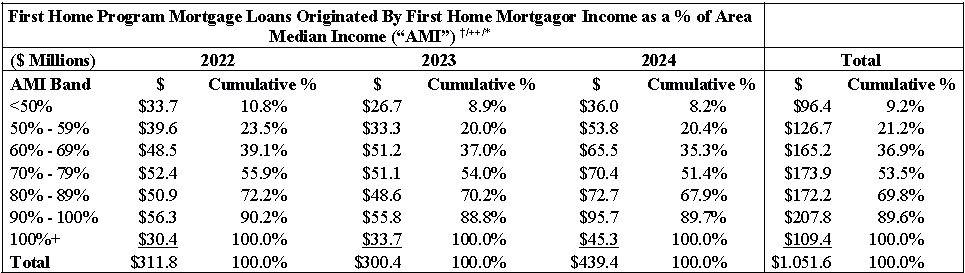

From January of 2022 through December 31, 2024, pursuant to the First Home Program, NIFA purchased approximately $1.051 billion of First Home Mortgage-Backed Securities with proceeds of Bonds to finance 5,617 First Home Mortgage Loans (made primarily to first-time homebuyers), 89.6% of which served populations at or below 100% Area Median Income (“AMI”) and 53.5% of which served populations at or below 80% AMI, as set forth by AMI bands in the table below. (For purposes of AMI and the designation of the Offered Bonds as Social Bonds, NIFA uses the area median income limits as determined in accordance with the parameters of Section 143 of the Code and applicable to the First Home Program. As a result, in some cases, in accordance with the Code, AMI is based upon the state-wide area median income for Nebraska.) These First Home Mortgage Loans were provided to Nebraskans throughout the State from 81 of the State’s 93 counties. (99.5% percent of Nebraska’s population lives within those 81 counties where homes were financed with First Home Mortgage Loans through the First Home Program.) In conjunction with these First Home Mortgage Loans, NIFA provided approximately $26.2 million of HBA Loans, providing down payment and closing cost assistance to 3,008 First Home Mortgagors (53.55% of borrowers), ranging from $815 to $19,200 with an average amount of $8,710 per First Home Mortgagor. The average First Home Mortgagor’s household income was $71,184 and the average purchase price of the home financed was $198,177.

In addition to the foregoing, during 2022, 2023 and 2024, NIFA financed, with amounts available pursuant to the Indenture, Community Program Loans originated by Habitat for Humanity (“Habitat”), in the aggregate amount of $2,691,000 which were made to First Home Mortgagor’s purchasing Habitat homes, pursuant to a program carried out by Habitat.

Historical data in the format provided below (and updated each year) assists NIFA in making its determination that the use of the proceeds of any NIFA designated Social Bonds dedicated to financing newly originated First Home Mortgage Loans is expected to meet the goals discussed above for their designation as Social Bonds.

The information set forth herein concerning the designation of the Bonds as “Social Bonds” has been furnished by NIFA and by other sources that are believed to be reliable. It should be noted that there is currently no clearly articulated definition of (legal, regulatory, or otherwise), nor market consensus as to what constitutes a “social bond” or an equivalently labeled program. Nor is there an agreed upon standard as to what precise attributes are required for a particular program to be defined as “social” or such other equivalent label. No assurance can be given that a clear definition will develop over time, or that, if developed, will include the program to be financed with the proceeds of the Bonds. Accordingly, no assurance is or can be given to investors that any uses of the Bonds will meet investor expectations regarding “social” or other equivalently-labelled performance objectives.

Image Gallery